Millennials and Gen Z Love Both Innovation and Tradition

Americans’ view of tea has changed dramatically since 1774 when John Adams famously called it “a traitor’s drink.” Even in those days, according to historian Caroline Frank, Ph.D. and author of Objectifying China, Imagining America: Chinese Commodities in Early America, Adams was talking out of both sides of his mouth, as besides being a future president, he was also a savvy businessman, advocating for the emerging United States to get involved with the highly lucrative East Indian tea trade as soon as possible.

Colonial Americans enthusiastically drank smuggled tea throughout the War for Independence, but tea drinking was viewed as unpatriotic after 1773. The New World had already begun a love affair with coffee beginning in 1720 when French naval officer Gabriel de Clieu, planted the first coffee in Martinique. During the 50 years that followed, commercial production was established in Haiti and Mexico. Eventually, coffee became America’s hot beverage of choice. But during the past few decades, all types of tea, from herbal to Pu’er, have re-emerged in premium formats, leading Starbucks to acquire Teavana, Unilever (Lipton) to purchase both TAZO and Pukka Herbs and Peet’s Coffee & Tea to buy Mighty Leaf Tea.

Always a little ahead of the curve, Mel and Patricia Ziegler, founders of Banana Republic, founded The Republic of Tea in 1992, about a decade after selling BR to The Gap. Two years later, they sold the Republic of Tea as well, which has flourished under its current management.

These brands, along with Rishi Tea & Botanicals, Numi Organic Tea, PepsiCo’s Pure Leaf, and Coca-Cola’s Honest Tea, are all pursuing the same consumer: Millennials.

No cohort has changed the American tea market as fast as the country’s 73 million Millennials and 61-million-member Gen Z. Their preferences and values exert tremendous influence, leading brands to expand the range of tea options, market authentic and multiple styles of tea, and modernize the way that tea is prepared and presented.

“What makes the super-premium tea category unique, in my view, is the importance of storytelling with regard to ingredient origin, processing, and functional appeal,” according to Euromonitor Beverage Analyst Howard Telford. “There is a definite romance and aspect of discovery to the category that I think keeps consumers coming back,” Telford explained to BevNet readers.

But transparency is to no avail when companies ignore a “clean label” mandate that excludes artificial flavors, coloring, preservatives, and sourcing at origin that reflects sustainability and environmental stewardship. Spritzing up the tea to make it bubbly or blending in a dram of spirits are popular, but “synthetic” anything is out.

Plant-based Ingredients Sought

“Younger US consumers tend to prioritize all-natural and plant-based ingredients,” according to Telford. “Both concepts are inextricably linked to what the younger consumer considers to be a ‘healthier’ beverage and – crucially – linked to what the consumer is prepared to pay more for on the shelf. This supports some of the trading up effect in the tea category.”

The Tea Association of the USA reports that 87% of American Millennials drink tea. While the youngest members of Gen Z are less than ten years old, the eldest are now in their early 20s and not shy about making their preferences known.

Both Millennials and Zers prefer premium products, often containing botanicals. They like herbal teas. They value convenience and frequently purchase ready-to-drink tea. Market researchers find that Millennials actively seek uncommon teas, such as Kenyan purple, and that these two groups “want clean-label and sustainably and ethically sourced tea.”

A 2019 GlobalData survey revealed that Gen Z consumers have a definitive preference for green tea, at 38%, compared to black tea at 19%. The same survey asked Gen Zers what flavors/infusions they preferred in tea. They opted for “herbal” and “sweet” equally at 67%. Millennials preferred “fruity” (72%) and “herbal” (64%). Plain or unflavored options garnered the lowest responses for both generations in this survey.

Other studies of Millennial food and beverage preferences indicate that they are “more experiential,” and extremely interested in how their choices affect how their bodies function.

Alyssa Harding, executive director of the Sustainable Food Trade Association (SFTA), confirmed that sustainability is an important consideration in choosing teas.

“Over the past few years, research studies have shown that Millennials are putting a higher priority on sustainability than the generations that came before them,” she said.

“They are awarding brand loyalty to products that leverage sustainable innovation as a differentiator in the marketplace, and we’ve especially seen demand for sustainable packaging solutions.” Harding pointed to a recent survey by EcoFocus Worldwide that indicated Millennials view “eco-friendly” living as a specific way to improve quality of life, “which translates to their shopping habits and expectations for the products they buy,” she said.

Some newer tea companies have had younger tea drinkers in mind from the very beginning. Rishi Tea, founded in 1997, for example, offers not only classic tea styles, but a wide variety of herbal teas, including ginger, mint, and turmeric, as well as teas that are blended with botanicals.

Taking a step further, Rishi features “Adaptogenic Teas” (an “adaptogen” is a plant or herb “considered to aid the body’s resistance to stress.”) Examples are Himalayan Tulsi, a black tea blend, and Tulsi Chai. Yet another category is “Nootropic Tea”— a nootropic substance is one believed, among other criteria, to “enhance memory and the ability to learn,” and “helps the brain function under disruptive circumstances.” Examples are Teahouse Matcha and Blue Jasmine, a blend of Chinese green tea and Thai butterfly pea flowers.

Taking a step further, Rishi features “Adaptogenic Teas” (an “adaptogen” is a plant or herb “considered to aid the body’s resistance to stress.”) Examples are Himalayan Tulsi, a black tea blend, and Tulsi Chai. Yet another category is “Nootropic Tea”— a nootropic substance is one believed, among other criteria, to “enhance memory and the ability to learn,” and “helps the brain function under disruptive circumstances.” Examples are Teahouse Matcha and Blue Jasmine, a blend of Chinese green tea and Thai butterfly pea flowers.

Tazo Tea was founded in 1994 by the late Steven Smith, who is described on the company website as “Merlin meets Marco Polo.” The company was later acquired by Starbucks, which sold the brand to Unilever for $384 million in November 2017. Tazo caters to a younger consumer who favors convenience, offering several options, including traditional tea bags, K cup pods, and bottled teas. Tazo also offers unique blends, such as “Prickly Pear Cactus,” one in a series of regional teas marketed to consumers in the Midwest (Wild Apple Sarsparilla), New England (Elderberry Blackberry) and The Rocky Mountains (Juniper Mint Honey).

Unconventional Tea

Millennial business owners translate their own preferences into tea places catering to their peers. The San Francisco Bay and Silicon Valley proved to be an ideal laboratory for these start-ups.

Millennials Andrew Chau and Bin Chen started Boba Guys as a San Francisco pop-up in 2011. A rapidly expanding boba empire now includes several Bay Area stores and boba locations in Los Angeles, and New York. One reason for their success is the ability to adapt to their Millennial and Gen Z customers with innovations such as nitro tea, which they introduced in 2016. Their partnership with local Black Sands Brewery enabled them to innovate a process that “creates a cascading beverage that brings out a tea flavor that is silkier and sweeter without added dairy or sugar.”

Millennials Andrew Chau and Bin Chen started Boba Guys as a San Francisco pop-up in 2011. A rapidly expanding boba empire now includes several Bay Area stores and boba locations in Los Angeles, and New York. One reason for their success is the ability to adapt to their Millennial and Gen Z customers with innovations such as nitro tea, which they introduced in 2016. Their partnership with local Black Sands Brewery enabled them to innovate a process that “creates a cascading beverage that brings out a tea flavor that is silkier and sweeter without added dairy or sugar.”

Across the Bay in Berkeley, fellow Millennial Ali Roth started out as a wholesaler, then opened her popular Blue Willow Teaspot. Roth specializes in Japanese loose-leaf teas. She also offers classes in chadō and finds that her Millennial and Gen Z customers are interested in learning the Way of Tea. “A lot of that is people interested in the history and mindfulness practice, seeing how they can learn from the tea ceremony and adapt some of the practices to fit a more modern context,” she said.

Roth explains that these age groups are interested in teas’ specific origins, details about the people making the tea, and unusual processing methods.

“Tea trends are also picked up a lot more in this age range so matcha and pu’er are very popular right now, as well as some oolongs,” she said. To reach younger customers, she spends time on Instagram presence, “because it’s such an important avenue for getting messages out.”

Silicon Valley-based Milk Tea Lab, founded by Millennials KM Loi and M. G. Ha, offer customers a choice of black, oolong, or jasmine tea. The base tea is then combined with toppings that include grass jelly, handmade boba, and egg or tofu pudding. The San Jose location offers a “hot pot” that prepared for groups in the shabu shabu caldron.

In Chicago, the founders of Argo Tea, launched in 2003, are technically Gen X’ers, but their mode of doing business and philosophy put them firmly in the modern realm. Boyhood friends Arsen Avakian and Simon Simonian, who emigrated from Armenia in the ’90s, teamed up with Frenchman Daniel Lindwasser, and as their tea houses multiplied (including creating a “teaosk” at the University of Chicago Medical Center on the city’s South Side), their goal morphed from becoming the “Starbucks of tea,” to Avakian’s more recent pronouncement: “Starbucks is more like Windows PC—it’s old, less healthy and designed for everyone—and we want to be more like Mac: young, healthy, cool and a more unique, innovative brand.”

The partners have kept up with trends, offering “teapuccinos” like Earl Grey Vanilla Creme and Maté Laté™, made with Brazilian maté. Argo menus also feature kombucha and bubble teas alongside a wide variety of teas from around the globe.

In New York City, Millennial Shunan Teng left her career in financial advising to open Tea Drunk in 2004. Teng’s venture, emphasizing classic Chinese teas and aimed at furthering customers’ knowledge of them, has found an enthusiastic young audience. Blogger Chloe Mauvais, writing for nylocal.com, commented: “Tea Drunk is the first tea house I ever visited, so it has a special place in my heart. I remember my first few hours as a crash course in tea. The woman who helped me explained every step of the brewing process, from warming up the dainty porcelain cups with splashes of hot water, to blooming the tea leaves in a glass vessel before transferring the first, semi-transparent brew into a pot. By the time the leaves exhausted their flavor, I was buzzing with caffeine and excitement. I was also weirdly relaxed, but I think that was because they played the Howl’s Moving Castle soundtrack on loop over the sound system.”

Millennials and Gen Zers, like everyone else, are drinking their teas at home for now. Circling back to historian Caroline Frank, she notes that even in the early days, tea, besides being a means of socializing, was regarded as medicinal, “something to drink when you are sick.”

According to Mo Sardella, marketing director G.S. Haly Company, tea sales online surged as much as three-fold among tea importer G.S. Haly’s customers.

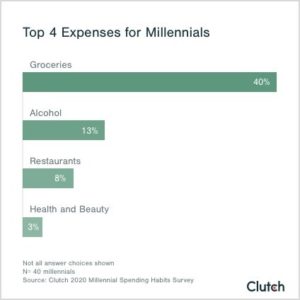

A majority of Millennials (60%) reduced their spending during the early months of the pandemic, according to a survey by Clutch, a B2B ratings and review platform. Recession-wary, they contributed to an unprecedented US savings rate of 33% in April. Only 5% of Millennials reported spending more money than the previous month during March and April. Food was the exception. Groceries were the top expense for 40% of Millennials, reports Clutch. Half the Millennials surveyed spent less dining out, but 50% say they are still eating takeout and ordering delivery. Only 28% have not used food pickup and delivery options since the start of the pandemic, reports Clutch.

Post-pandemic, it is a sure bet that young tea lovers will return to the tea houses, fuel both innovation and new products, as well as respect for ancient preparations, presentations, and traditions.